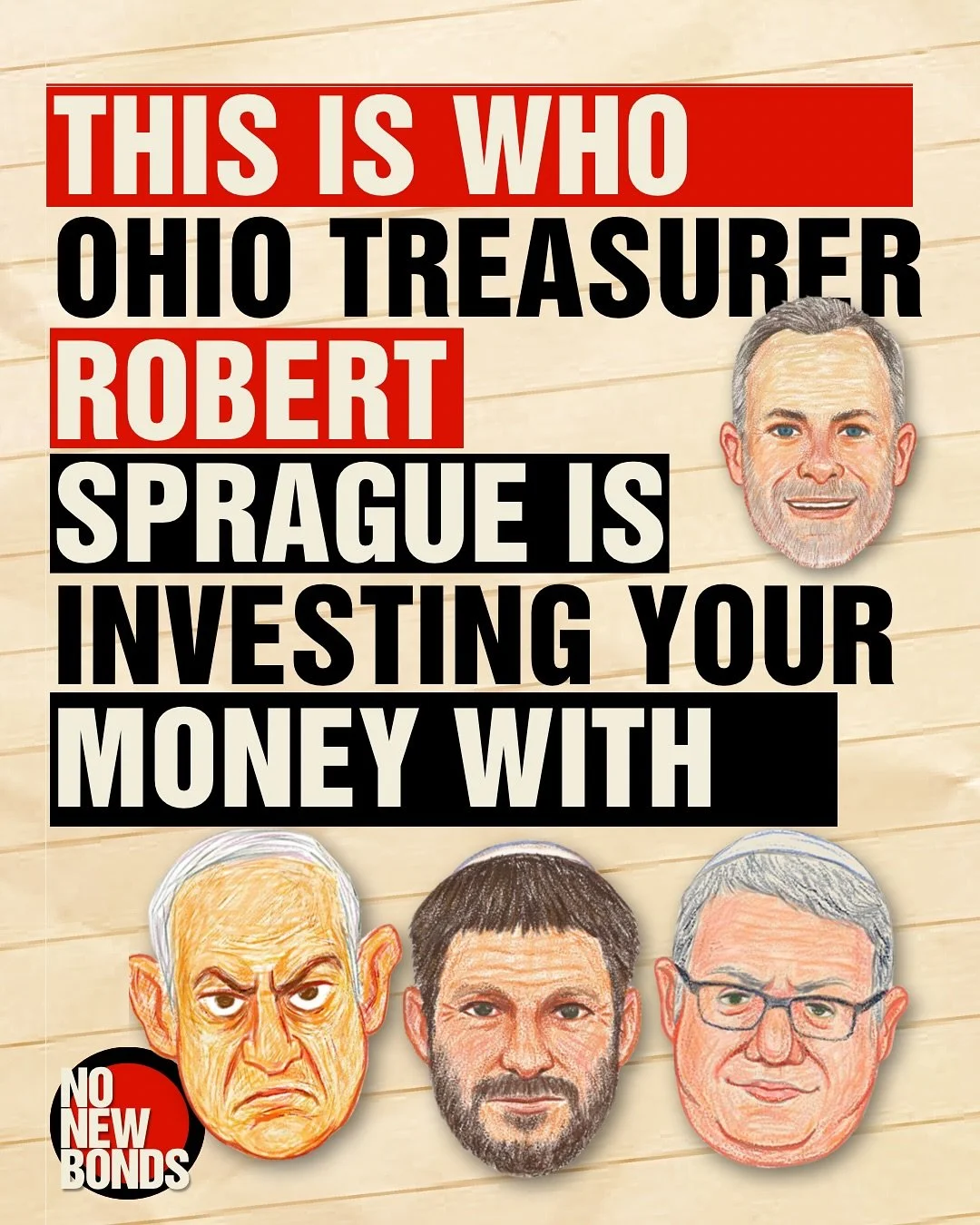

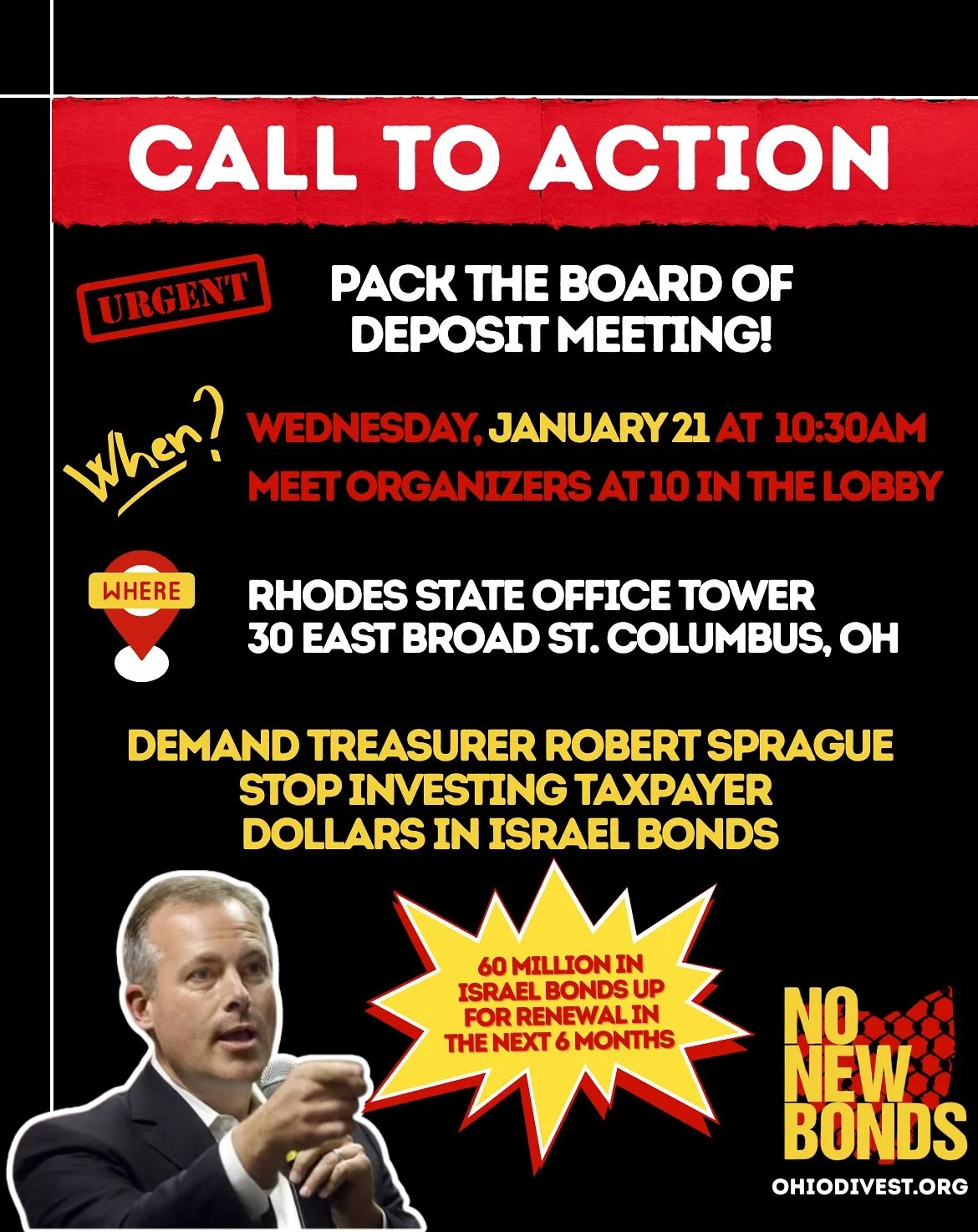

BREAKING: Treasurer Sprague Invests $25 Million in Israel Bonds

BREAKING: Treasurer Sprague Invests $25 Million in Israel Bonds

DIVEST FROM ISRAEL BONDS.

INVEST IN OHIO.

End Ohio’s Risky Investments in Israel Bonds

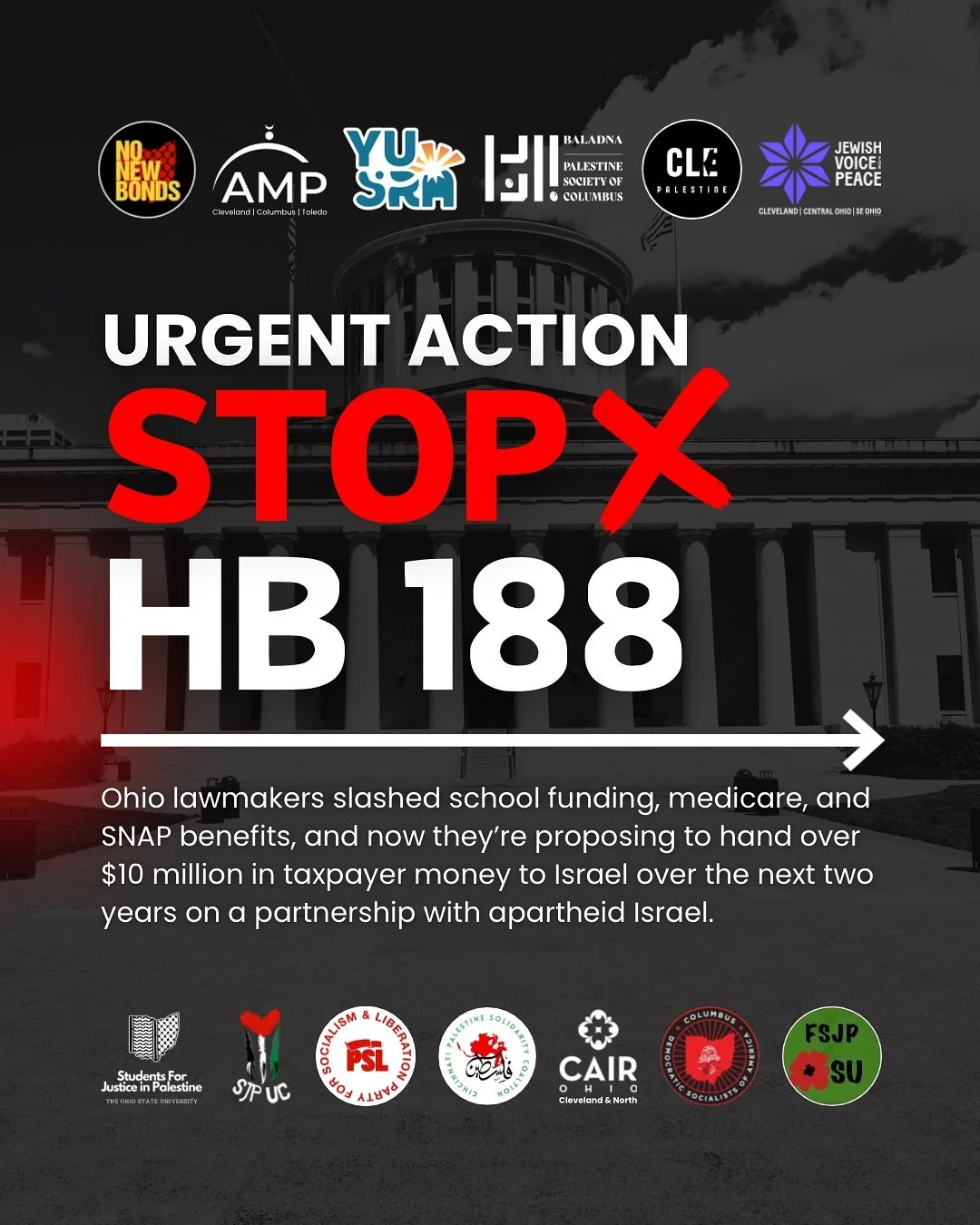

Over $330 million Ohio taxpayer dollars are currently invested in Israel Bonds. These investments are made using public funds, and without any public oversight. Join your neighbors in speaking up and demanding our representatives commit to No New Bonds.

-

A bond is generally made by a company that needs capital investment. The buyer of the bond goes into an agreement with the business, which will most commonly repay the principal amount plus interest at the time of the bond’s maturity date.

“Israel Bonds” is the commonly known name for the Development Corporation for Israel (DCI), a business founded in 1951 and headquartered in New York City for the purpose of growing and developing the State of Israel.

While the use of bonds as a form of investment in a state/country/region is not exclusive to Israel, this type of bond is often touted for its support of essential infrastructure and environmentally friendly initiatives, often in developing countries.

-

From israelbonds.com in December 2024, “Our President and CEO Dani Naveh […] highlighted the unprecedented surge in Israel Bonds sales following the events of October 7 and introduced the ‘Invest in Life’ campaign.”

While the exact investments of the company are not required to be made clear, the above horrendously hypocritical and ironic statement, amongst others, gives a strong nod to the support of military defense, which in Israel’s case, is much more of an offensive strategy.

To understand the extent to which this money is inherently tied to military action, Palestine/Israel as a whole is the size of New Jersey, and Israel has the 15th largest military budget in the world (a statistic from 2023, though the current accuracy is questionable). Military in Israel is a foundational aspect of the state, its occupation, and its expansion. With few exceptions, every Israeli citizen is required to serve two to four years in the military.

It is absurd for any individuals, counties, institutions, states, or countries to profit (directly or indirectly) from military occupation, and profit is the promise of a bond investment – with returns of around 4-6% in the case of Israel Bonds. However, the promise of that return is at risk.

-

Investors rely on bond rating agencies to know whether they can trust a company to make good on its returns. While ratings remain at investment grade for Israel Bonds, their ratings have been downgraded by the three largest international credit rating agencies: S&P, Moody’s, and Fitch.

If a bond is downgraded, it means there is an increased risk of default, not only on a company’s interest payments, but also on an initial investment.

The state of Ohio currently holds over $262 million in Israel Bonds, invested by State Treasurer Robert Sprague. If ratings continue to drop and the state continues to invest, we have a higher risk losing this taxpayer money.

In public reports, bond investments are accompanied by their Moody’s and S&P ratings, but in the case of Israel Bonds, ratings are unlisted at the county level. If the ratings were to be shared in public reports, viewers could clearly see that they hold the lowest rating in Ohio’s portfolio.

Fundamentally, these bonds are a house of cards. There is no way that a business, or in this case the State of Israel, can sustain returns on investment without either expanding or continually selling more bonds.

We are a populous state (amongst other states, counties, institutions, and individuals across multiple countries) investing in a state with the relative size and population of New Jersey. It has never made sense to even allow Israel Bonds investments to be made at a county or state level.